real property taxes las vegas nv

Real Property Tax Payment Schedule Nevada. Road Document Listing Inquiry.

Free Nevada Real Estate Purchase Agreement Template Pdf Word

Ask any homeowner about expenses and theyll tell you.

. In Las Vegas NV the estimated annual property taxes can be calculated at roughly 5 to 75 of the. Assessor - Personal Property Taxes. The assessed value is equal to 35 of the taxable value.

2 beds 2 baths 1368 sq. This public search page can be used to determine current property taxes. PROGRAM OF THE GREATER LAS VEGAS ASSOCIATION OR.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. NRS 3614723 provides a partial abatement of taxes. Let Us Help You Find The Best Pro For the Best Price Every Time.

Our Rule of Thumb for Las Vegas sales tax is 875. Clark County Detention Center Inmate Accounts. Like us on Facebook.

Real PropertyVehicle Tax Exemptions Nevada Wartime Veterans Tax Exemption applies to residents who have served in the Armed Forces of the United States in any of the following. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. Taxes are delinquent 10 days after due date.

The property tax rates in Nevada are some of the lowest in the nation. Nearby homes similar to 12228 Capilla Real Ave have recently sold between 660K to 1110K at an average of 295 per square foot. SOLD MAR 7 2022.

2Reviews applications for exemption and determines whether the transaction. Dont miss the big stories. Compared to the 107 national average that rate is quite low.

Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. Please visit this page for more information. Find All The Record Information You Need Here.

Counties in Nevada collect an average of 084 of a propertys assesed fair. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. You must have either an 11-digit.

Single family home located at 4927 Snow White Rd Las Vegas NV 89124 on sale now for 11000000. This 2 bedroom 2 bath manufactured home has. 123 Main St.

Real Property Delinquent Tax Penalty Chart. Ad Stop Procrastinating - Get Matched To Top Rated Local Appraisers Today. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. 3350 Isle Royale Dr Las Vegas NV 89122 249900 MLS 2401882 Welcome Home. About This Home.

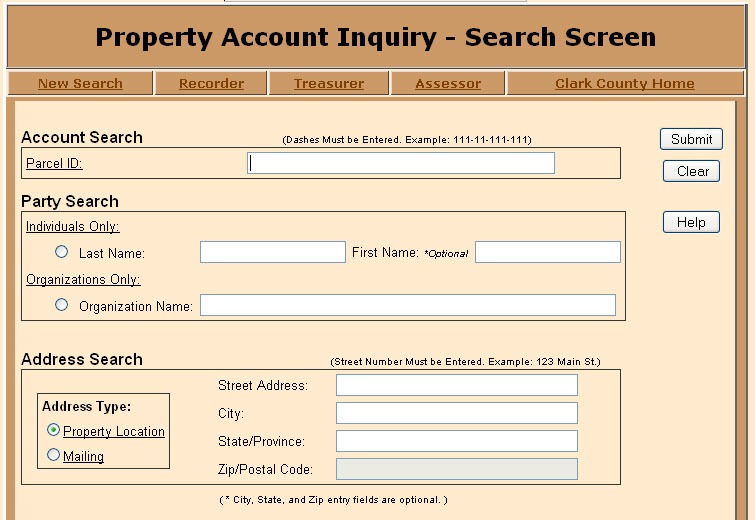

If youre thinking about buying a home in Las. Property Account Inquiry - Search Screen. 111-11-111-111 Address Search Street Number Must be Entered.

Searching Up-To-Date Property Records By County Just Got Easier. Technically the Las Vegas sales tax rate is between 8375 and 875. As a general rule of thumb annual estimated property taxes can be calculated at roughly 5-75 of the purchase price.

Don C Send an email February 14 2022. 3rd Quarter Tax Due - 1st Monday of January. The figure you are left with is your capital gain on the property and based on your non-property income you will have to pay up to 30 in federal and state taxes on your capital.

Account Search Dashes Must be Entered. Skip to main content. View 50 photos of this 4 bed 7 bath 6918 sqft.

The State of Nevada sales tax rate is 46 added to. Ad Unsure Of The Value Of Your Property. The states average effective property tax rate is just 053.

Business Life Style Real Estate Property Taxes in Las Vegas 2022. 0 71 2 minutes read. What taxes do Nevada residents pay.

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be. If youre a first-time buyer. While tourists come to Nevada to gamble and experience Las Vegas residents pay no personal income tax and the state offers no corporate tax no.

2250 Las Vegas Boulevard NorthSuite 200North Las Vegas NV 89030Phone 702 633 1213Fax 702 399 1716 Manager Lorena Candelario SR WA Senior Office Assistant Tracee Hales Real. January 17 2022 - 115 pm. Homeowners in Nevada are protected from steep increases in.

11 Quintessa Cir is a 10153 square foot house on a 073 acre lot with 5 bedrooms and 75 bathrooms. This home is currently off market - it last sold on.

Top 10 Reasons To You Should Move To Las Vegas Nv

What S The Property Tax Outlook In Las Vegas Mansion Global

Taxpayer Information Henderson Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Vs California Taxes Explained Retirebetternow Com

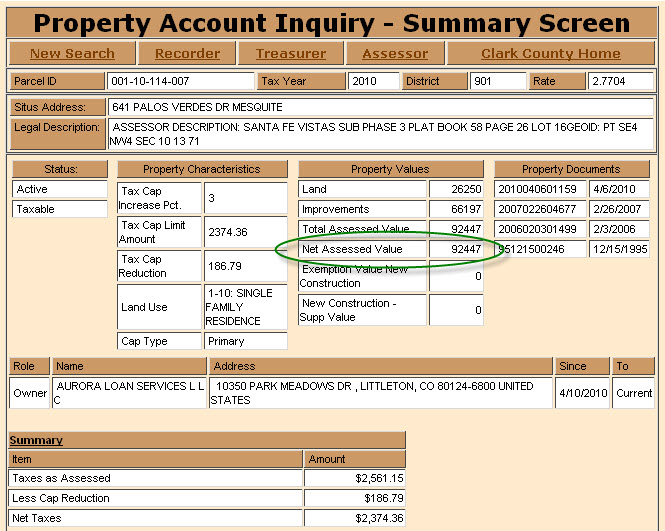

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Nevada Tax Exemption Changed Real Estate Deals In 2007 Las Vegas Review Journal

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes Are Not Uniform And Equal In Nevada The Nevada Independent

Nevada Property Tax Calculator Smartasset

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate